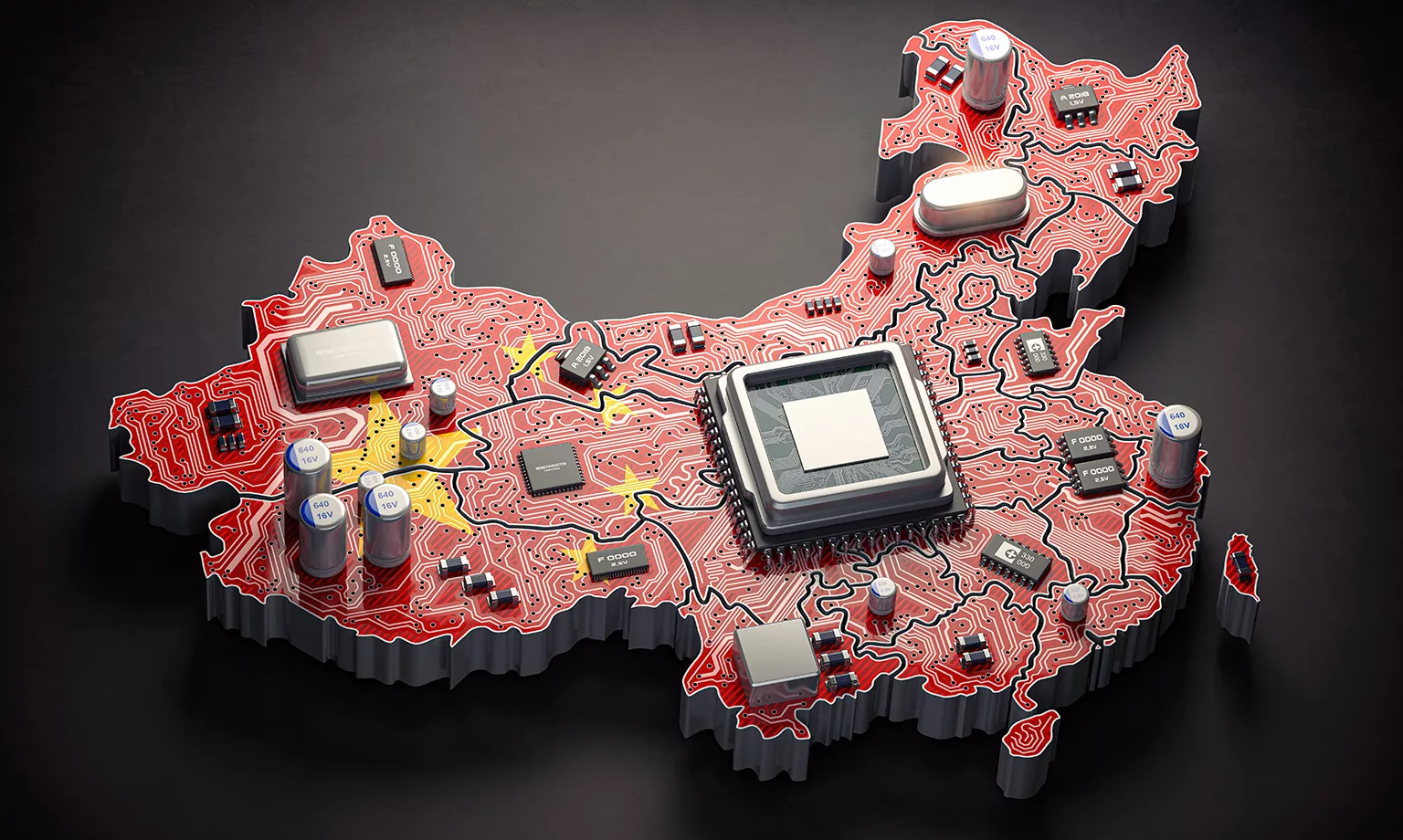

Following a recently released report by Resilinc, we discuss the impact of export restrictions on the global semiconductor industry with CEO and co-Founder, Bindiya Vakil.

Q&A WITH BINDIYA VAKIL, CEO AND CO-FOUNDER, RESILINC

How have recent export controls imposed by China on gallium and germanium caused a surge in commodity prices?

China is the world’s largest germanium producer and controls 68 percent of global germanium refinery production in 2022, so the new restrictions will impact commodity prices. Additionally, China produces 94 percent of the world’s supply of gallium and so export controls will increase that pricing too. In fact, recent data shows a 50 percent increase in the price of gallium, so finding alternative suppliers will be critical going forwards.

Owing to China’s position as the largest reserve of rare earth metals globally, is this trend expected to persist?

BV: China dominates with over 60 percent of all global rare earth oxide reserves, so the newly implemented licensing system will be an ongoing cause for concern for many businesses and manufacturers in the high-tech and semiconductor space. It is too early to tell exactly how long the trend of increased commodity prices will continue, however, according to Resilinc’s data, 4,400 sites have been impacted by the export control measures. With just 45 alternative sites available, it will be some time before prices stabilise.

But this isn’t the first time China has restricted exports. In 2010, China restricted exports of rare earth elements to Japan as a result of a territorial dispute. This also resulted in soaring prices while Japan struggled to find alternative sources.

What’s more, there are few alternatives that perform as well as germanium and gallium. Though silicon can be used instead of gallium in low-end chip applications such as cars, it cannot be used within more advanced technology like satellites or military applications. Similarly, silicon can be used instead of germanium, but its use is even more limited to only high-frequency electronics like infrared applications and light-emitting diodes.

Germanium and gallium are both featured on the critical minerals lists of the US and EU, so the reduced supply and resulting increase in commodity prices will only cement their reputation as highly sought after resources.

What upstream impacts are Western supply chains likely to experience as a result of surging commodity prices?

Currently, China typically exports germanium and gallium to companies in Japan and Europe as well as the US, with Japan and South Korea being top importers. These new export restrictions are likely to impact products like semiconductors, sensors, as well as larger products like electric vehicles (EVs) and solar panels.

Looking ahead, countries will need to increase domestic production and diversify their supply chains to reduce reliance on single-source suppliers, further reinforcing ‘China Plus One’ thinking within organisations across European countries and beyond. Some mining companies in the Democratic Republic of the Congo (DRC) and Russia are already looking to increase germanium production to meet fresh demand, however it remains to be seen if this production will be readily available to Western markets.

Western countries that produce germanium and gallium include the US, Canada, Germany, and Japan, but it takes time to ramp up production due to the inability to process the materials, as well as environmental regulations in place preventing processing and mining due to the significant pollution it causes.

Equally, what will the consequences of the latest export restrictions be for the global semiconductor industry?

According to Resilinc’s data, we’ve mapped over 220,000 different parts that are impacted and have been disrupted by the export restrictions – primarily in the semiconductor, electronics, and aerospace and defence industries.

Additionally, our data shows that this disruption could take an average of five weeks to recover from, and as many as seven years for some suppliers. Clearly, this adds to the already difficult picture for those suppliers and manufacturers impacted by semiconductor shortages in particular. As a result, the ‘China Plus One’ approach, whereby organisations look beyond only China to alternative suppliers to meet their current and future demand, is one of the most likely consequences.

Why are supply chain risk mitigation and AI the best methods to minimise the threat of commodity shortages?

Mapping and monitoring your suppliers is the foundation to any resilient supply chain. It goes to the heart of what it means to mitigate risk, as if you don’t have visibility over who is in your supply chain and what is in your supply chain (i.e. which commodities), you cannot take the necessary actions to limit or entirely prevent the impact; after all, 80 percent of supply chain disruptions originate from sub-tier suppliers. With your supply chain mapped, you can then monitor it 24/7 for any potential threats. We track and monitor over 150 million news feeds across 200 countries and 100 languages via artificial intelligence (AI), which is fundamental to giving you the most up-to-date, clean data on what’s impacting your supply chain. Businesses then gain a head start in predicting where potential commodity disruption might occur within their supply chain so that proactive measures can be taken.

What makes Resilinc an expert in how best to implement these solutions?

At Resilinc, we’ve been tracking supply chain resiliency since 2010 and have mapped the supply chains of over 800,000 global suppliers down multiple tiers, covering sub-tier sites, parts, as well as raw materials. We have the largest collection of supplier-validated data of any organisation, and we’re very proud that over 100,000 organisations use Resilinc’s resiliency solutions to protect their supply chains.

A key AI solution we offer to organisations dealing with commodity shortages is CommodityWatchAI, a predictive algorithm combining machine learning with Resilinc’s data that identifies cost opportunities and the best possible pricing across commodities, including rare earth minerals like gallium.